Business Insurance in and around Owatonna

Owatonna! Look no further for small business insurance.

No funny business here

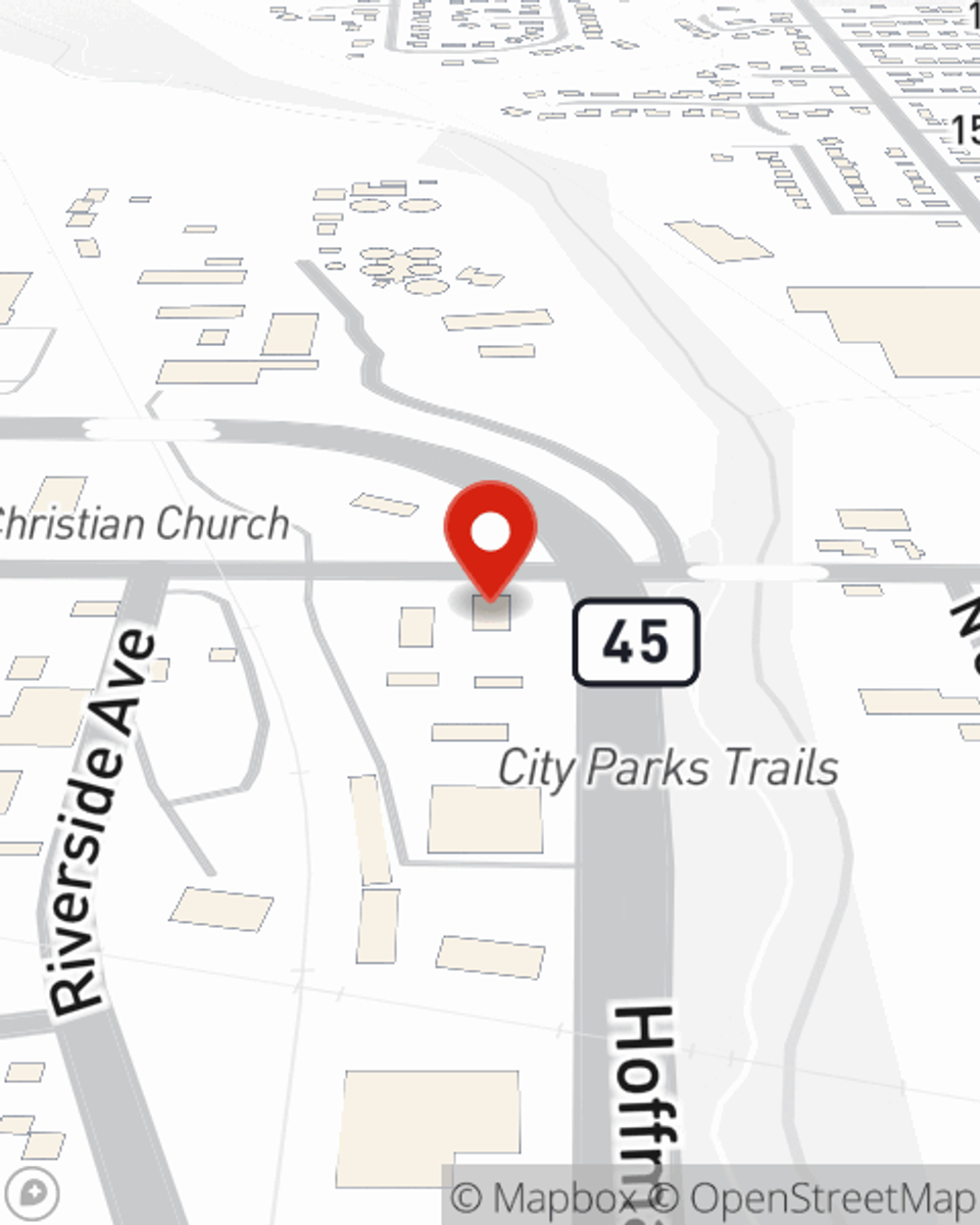

- Owatonna

- Waseca

- Blooming Prairie

- Medford

- Ellendale

- Geneva

- New Richland

- Hayfield

- Faribault

- Austin

- Nerstrand

- Elysian

- Steele County

- Dundas

- Northfield

- Dodge Center

- Claremont

Help Protect Your Business With State Farm.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or loss. And you also want to care for any staff and customers who hurt themselves on your property.

Owatonna! Look no further for small business insurance.

No funny business here

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Judy Plemel is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Judy Plemel can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and visit State Farm agent Judy Plemel's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Judy Plemel

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.